What are capital gains?

If you are willing to pay a higher amount for your investment, this is capital gain. But many things you own will depreciate with age and sale of most items will not count towards capital gains. You are also still liable under the Income Tax Code for any gains you make in your life from the purchase. When selling art, antique vehicles and jewelry you sell the goods for a lot more than your purchase price. Property like properties and collector goods, including paintings and antiques are subject to capital gains for purposes. They are defined differently and sometimes higher taxes (as outlined above) based on the income.

How Are Capital Gains Taxed?

Capital gains are taxed at different rates than ordinary income. For example, long-term capital gains (gains on assets held for more than one year) may be taxed at a lower rate than short-term capital gains (gains on assets held for one year or less). In addition, some capital assets, such as collectibles or certain types of real estate, may be subject to special capital gains tax rates.

What is A Capital Gain?

A capital gain is realized when an individual sells a capital asset for more than the original purchase price. The capital gain is the difference between the sale price and the original purchase price. Capital assets can include stocks, bonds, real estate, and personal property purchased for personal use such as furniture or a boat. The Internal Revenue Service (IRS) taxes individuals on capital gains in certain circumstances.

If you have questions about whether a capital gain is taxable and at what rate, you should speak with a tax advisor. When it comes to capital gains taxes, it’s better to be safe than sorry.

Summary On Capital Gains

A capital gain is the increase in a capital asset’s value and is realized when the asset is sold. Capital gains apply to any type of asset, including investments and those purchased for personal use. The gain may be short-term (one year or less) or long-term (more than one year) and must be claimed on income taxes. Unrealized gains and losses reflect an increase or decrease in an investment’s value but are not considered a taxable capital gain. A capital loss is incurred when there is a decrease in the capital asset value compared to an asset’s purchase price. Capital gains and losses can have a significant impact on an investor’s taxes, so it’s important to understand how they work before making any investment decisions.

How Are Mutual Funds Taxed?

For many investors, mutual funds are an attractive option because they offer the potential for high returns with relatively low risk. However, it’s important to be aware of the tax implications of investing in mutual funds. One key point to keep in mind is that mutual funds that accumulate realized capital gains throughout the tax year must distribute these gains to shareholders. This can create a taxable event for shareholders, who may be required to pay taxes on the distributed gains. As a result, investors should carefully consider the tax implications of investing in mutual funds before making any decisions.

Mutual Fund Distributions Taxation

When a mutual fund makes a capital gains or dividend distribution, the net asset value (NAV) drops by the amount of the distribution. A capital gains distribution does not impact the fund’s total return. However, shareholders are taxable on the distribution as it is considered taxable income. The shareholders will receive the fund’s capital gains distribution and get a 1099-DIV form outlining the amount of the gain and the type—short- or long-term. It is important to note that even though the NAV dropped by the amount of the distribution, this does not reflect a loss in value of the investment. The price per share simply adjusts to accommodate for the outflow of cash to shareholders. Therefore, in order to calculate your total return, you must take into account both the change in share price as well as any distributions received.

Know A Mutual Fund’s Tax Exposure Before Getting In

When choosing a mutual fund, tax-conscious investors should be aware of a fund’s unrealized accumulated capital gains, which are expressed as a percentage of its net assets. This figure represents the amount of taxable income that investors in the fund will be responsible for if the fund is sold. Capital gains exposure should be taken into account when choosing a fund, as it can have a significant impact on an investor’s tax bill. For example, a fund with a high unrealized capital gain component may be less attractive to a tax-conscious investor than a similar fund with a lower capital gains exposure. Ultimately, each investor must weigh the potential benefits and drawbacks of investing in a fund with a significant unrealized capital gain component before making any investment decisions.

Understanding How Mutual Funds Account For Their Capital Gains

Many people invest in mutual funds as a way to save for retirement or other long-term goals. However, investors need to be aware that these funds can generate taxable income in the form of capital gains distributions. These distributions occur when the fund sells securities for a profit and must be distributed to shareholders. Often, these distributions are made near the end of the calendar year and are taxable as ordinary income in the following year. In addition, shareholders will receive a 1099-DIV form detailing the amount of the distribution and how much is considered short-term or long-term gains. It’s important to note that this distribution reduces the fund’s net asset value, though it does not impact the fund’s total return. For investors who are close to retirement or in a high tax bracket, this can be a significant consideration.

Long-term vs. short-term capital gains: An overview

If a company sells an investment to the public at higher prices the results of that sale are known as capital gains. Capital includes bonds and stocks, precious metal jewelry and property. You pay taxes for your capital gains depending on the period you hold the assets before you sell them. Capital gain is categorized as either short or long term and is taxed accordingly. When selling a property it is essential you pay capital gains taxes as well – especially for those who trade online. First, your profits must be tax deductible. Secondly, you may hear about capital gains taxation being more favorable to others, but that isn’t always the case.

Capital gains are realized when an asset is sold for more than the original purchase price. The capital gain is the difference between the selling price and the cost basis, which is generally the purchase price plus any improvements made to the asset. Capital gains fall into two categories: short-term capital gains and long-term capital gains. Short-term capital gains are realized on assets that are sold after being held for one year or less, while long-term capital gains are realized on assets that are sold after being held for more than one year. Both short-term and long-term capital gains must be claimed on your annual tax return. Understanding this distinction and factoring it into investment strategy is particularly important for day traders and others who take advantage of the greater ease of trading in the market online.

Advantages of Long-Term Capital Gains

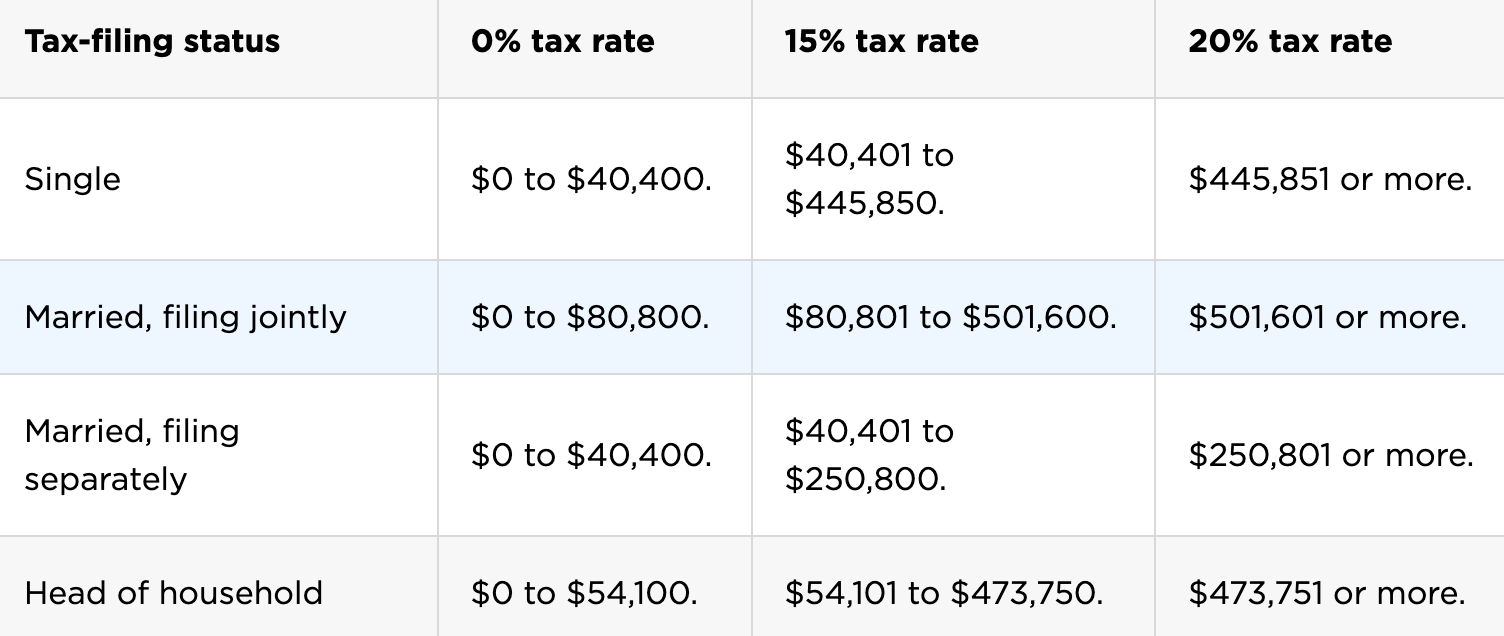

Long-term capital gains are taxed at a lower rate than earned income, short-term capital gains, interest, and non-qualified dividends. The tax rates for long-term capital gains can be as low as 0%, depending on your tax bracket. This is a significant advantage for investors who are looking to grow their wealth over the long term. Additionally, long-term capital gains are not subject to state and local taxes in most cases. This can save you thousands of dollars in taxes each year. Lastly, long-term capital gains can be used to offset short-term capital losses. This can help reduce your tax bill and maximize your investment returns.

- One of the benefits of investing is that you don’t have to pay taxes on your gains until you sell the investment. This tax deferral can be a great way to grow your wealth, as it allows your money to compound without being taxed each year. Additionally, if you move to a state with no income tax before selling the investment, you may be able to avoid paying state tax on the gains as well. This is yet another way that investing can help you grow your wealth tax-free.

- The tax system is progressive, meaning that people with higher incomes pay taxes at a higher rate than those with lower incomes. However, there are certain types of income that are taxed at a lower rate than earned income, such as long-term capital gains. As a result, people who live off of investment income often end up paying tax at a lower rate than those who earn a salary or wage. While this may seem unfair, it’s important to remember that the tax code is designed to encourage investment. If capital gains were taxed at the same rate as earned income, investors would be less likely to put their money into long-term investments, which can have a positive impact on the economy.

- Basis is reset to the value at the time of death and neither the estate nor the heirs pay capital gains taxes on any gains that occurred prior to death. This tax break is available for both real estate and stocks. When owners die, the tax basis of their assets “steps-up” to the current market value. This allows heirs to inherit property without paying taxes on the appreciation that occurred during the decedent’s life. The step-up in basis is a key tax break that can save heirs thousands, or even hundreds of thousands, of dollars in capital gains taxes.

Capital Gains Tax What You Need To Know

Capital gains represent the increase in the value of an asset. These gains are typically realized at the time that the asset is sold. Capital gains are generally associated with investments, such as stocks and funds, due to their inherent price volatility. But they can also be realized on any security or possession that is sold for a price higher than the original purchase price, such as a home, furniture, or vehicle. Capital gains can be a significant source of income for investors, but they are also subject to capital gains tax. This tax is levied on the profit realized from the sale of an asset, and it is typically paid by the seller. The capital gains tax rate depends on a number of factors, including the type of asset sold and the length of time it was held. For example, long-term capital gains are taxed at a lower rate than short-term capital gains. Capital gains taxes can be complex, but understanding them is important for anyone who owns investments or other assets that may be subject to capital gains tax.

What Triggers A Taxable Event?

When an asset is sold, capital gains realized. This means that it triggers a taxable event. unrealized gains, or paper gains and losses, reflect an increase in investment value, but it’s not considered a capital gain that should be taxed. Instead, capital gains are taxed when they’re realized — such as when an asset is sold. Unrealized capital gains and losses don’t trigger a taxable event because the asset hasn’t been sold. However, capital gains that are realized — such as when an asset is sold — are subject to capital gains taxes. The capital gains tax rate depends on how long you held the asset before selling it.

What Assets Are Not Eligible To Receive Capital Gains Tax Treatment?

- Business Inventory

- Rental or investment property

- Literary compositions

- Patents and inventions

- Depreciable business property

- Carry Forward Losses To Future Years

For example, short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains are taxed at a lower rate. Capital losses can offset capital gains of the same type — short-term against short-term or long-term against long-term. You can also use capital losses to offset up to $3,000 of ordinary income (such as wages) per year. If your capital losses exceed your capital gains for the year, you can carry the excess forward to future years and use it to offset future capital gains or up to $3,000 of ordinary income per year indefinitely.

Capital gains are taxed differently depending on how long the asset was held. Short-term capital gains, which are assets held for one year or less, are taxed as ordinary income. This means that the rate is based on the individual’s tax filing status and adjusted gross income. Long-term capital gains, however, are taxed at a lower rate. This is because these assets are held for longer than a year. The exact rate depends on the filer’s income and marital status. However, capital gains are generally taxed at a lower rate than regular income. This is because capital gains provide a way to grow wealth over time. For this reason, capital gains are an important part of investing for the future.

Capital Gains Calculator

Are there ways you could defer income taxes? Investing in an IRA and/or 401k can help reduce the capital gains tax. Here is a capital gains calculator that may be helpful to you.

How Are Precious Metals or Collectibles Taxed?

When it comes to taxes, there are a lot of different factors to consider. For instance, did you know that your taxable income can be affected by capital gains? Simply put, capital gains are profits from the sale of an asset, such as stocks or real estate. In most cases, capital gains are taxable at a rate of 15%. However, there are some caveats to be aware of.

Certain types of stock or collectibles may be taxed at a higher 28% capital gains rate, and real estate gains can go as high as 25%.

Moreover, if the capital gains put your income over the threshold for the 15% capital gains rate, the excess will be taxed at the higher 20% rate. So if you’re planning on selling any assets in the near future, it’s important to do your research and make sure you’re aware of all the potential tax implications.

Can I Deduct Losses From The Sale Of Personal Property?

Most people are aware that capital gains are taxable, but not everyone knows that there are certain exceptions. For example, if you sell your primary residence, the first $250,000 is exempt from capital gains tax. That figure doubles to $500,000 for married couples. Similarly, if you sell a car or other vehicle or your primary residence at a loss, you will be unable to deduct the difference on your taxes. This is because vehicles are considered personal property, and losses on personal property are not deductible. However, if you sell a piece of investment property at a loss, you may be able to deduct the difference on your taxes. This is because investment property is considered business property, and losses on business property can be deducted from other taxable income. As a result, it’s important to know the difference between personal property and investment property before you sell anything.

Long Term Gains Rate For High Income Investors

For high-net-worth investors, taxable income includes any gains from the sale of investments held for more than one year. These gains are taxed at a rate of 20%, plus the additional net investment income tax. This can result in a total tax rate of up to 23.8% on long-term capital gains. While this may seem like a high rate, it is important to remember that taxable income is only a portion of an individual’s total income. For many high-net-worth investors, the majority of their income comes from sources that are not subject to taxation, such as interest from bonds or dividends from stocks. As a result, the overall tax burden for these individuals is often much lower than the marginal rate would suggest.

Tell me the net investment income tax?

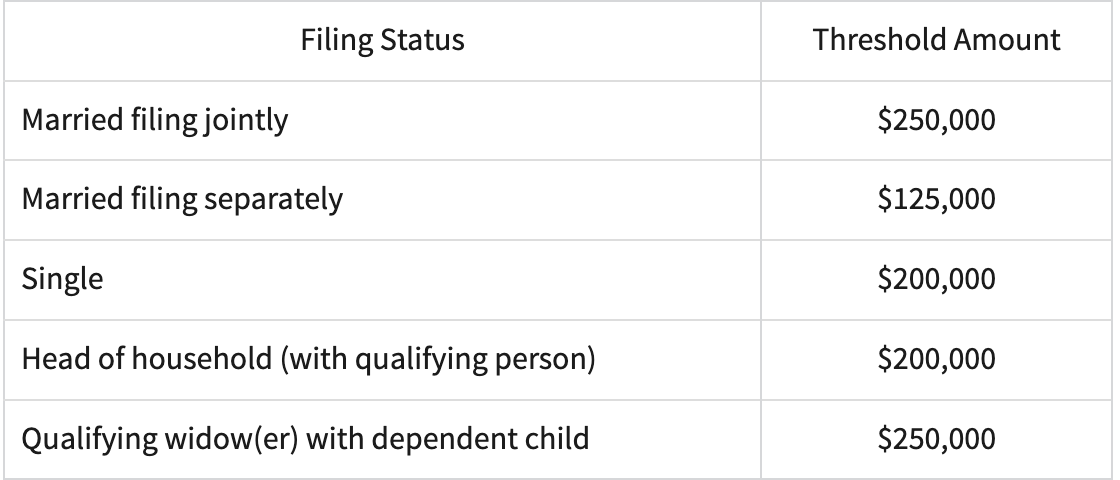

When individuals earn income on investment above certain thresholds, taxable gains are included in net investment income. Net investment income includes income derived from sales of investments which have not been compensated by a capital loss—along with income from dividend payments and interest, amongst other sources. A surtax on net earnings of investors is imposed at 3%.

Who Is Subject to Net Investment Income?

As of 2022:

How Is Modified Adjusted Gross Income Impacted by NIIT?

The Net Investment Income Tax (NIIT) is a tax imposed on certain investment income of individuals, estates, and trusts to the extent that their investment income exceeds their modified adjusted gross income (MAGI) for the tax year. The tax is imposed at a rate of 3.8 percent. For tax purposes, MAGI is AGI increased by the difference between amounts excluded from gross income under section 911(a)(1) and the amount of any deductions (taken into account in computing adjusted gross income) or exclusions disallowed under section 911(d)(6) for amounts described in section 911(a)(1). In the case of taxpayers with income from controlled foreign corporations (CFCs) and passive foreign investment companies (PFICs), they may have additional adjustments to their AGI. See section 1.1411-10(e) of the final regulations.

3 Individuals Not Subject To Net Investment Income Tax

- Under current tax law, nonresident aliens (NRAs) are not subject to the net investment income tax (NIIT). However, if an NRA is married to a U.S. citizen or resident and has made, or is planning to make, an election under section 6013(g) or 6013(h) to be treated as a resident alien for purposes of filing as Married Filing Jointly, the final regulations provide these couples special rules and a corresponding section 6013(g)/(h) election for the NIIT. This election allows the couple to jointly elect to treat the NRA spouse as a resident alien for tax purposes, which would then subject the couple’s investment income to the NIIT. These final regulations provide guidance on how to make this election and what effect it will have on the couple’s tax liability.

- A dual-resident individual who determines that he or she is a resident of a foreign country for tax purposes pursuant to an income tax treaty between the United States and that foreign country and claims benefits of the treaty as a nonresident of the United States is considered a NRA for purposes of the NIIT. This means that such an individual will be subject to tax on his or her US-source income at the applicable treaty rate, rather than at the higher NIIT rate. This provision can provide significant tax savings for dual-resident taxpayers who are able to claim treaty benefits.

- As a dual-status individual, you are subject to the tax on net investment income only for the portion of the year during which you are a resident of the United States. The tax is not prorated or reduced for dual-status residents. This means that you must pay the tax on your investment income for the entire year, even if you were only a resident of the United States for part of the year. The tax is levied on your investment income at a rate of 3.8%, and is applied to your taxable income after deductions and exemptions have been taken into account. If you have questions about how the tax applies to your specific situation, you should consult a tax advisor.

What Investors Are And Are Not Eligible For the Lower Rates?

When it comes to taxable income, not all investments are created equal. The IRS offers preferential tax treatment for certain types of assets, including qualified dividends and long-term capital gains. However, other types of income, such as interest from bonds and short-term capital gains, are subject to higher tax rates. As a result, it’s important to understand the tax implications of your investment strategy. While there’s no one-size-fits-all approach, taxable investors should be aware of the different types of investment income and how they’re taxed. By taking the time to understand the tax code, you can help maximize your after-tax returns.

What On Earth Is a Net Capital Gains?

The tax code is full of complicated rules and regulations, but there are some basic concepts that everyone should understand. One of these is the idea of a net capital gain. Basically, this is the amount by which your long-term capital gains exceed your short-term capital losses. If you have a net capital gain, it may be subject to a lower tax rate than your ordinary income tax rate. This can be a significant advantage for investors, so it’s important to understand how it works. The first step is to calculate your net long-term capital gain. This is simply your long-term capital gains minus any long-term capital losses and unused carryover losses from prior years. Next, calculate your net short-term capital loss, which is your short-term capital gain minus any short-term capital losses. Finally, compare the two numbers. If your net long-term capital gain is greater than your net short-term capital loss, then you have a net capital gain and may be eligible for the lower tax rate. However, if your net short-term capital loss is greater than your net long-term capital gain, then you will not receive the benefit of the lower tax rate. The tax code is complex, but this simple concept can save you a lot of money if you understand it and use it to your advantage.

Summary On Taxation Of Capital Gains

The taxation of capital gains has long been a hot topic in the American tax system. The lower rates allow for an advantage over wage workers, while also providing opportunities to deduct losses from one’s total taxable income if they are incurred during investment periods and selling investments at higher prices–potentially resulting stock-market returns without any taxes due!

Set Up A Retirement Ready Success Call

If you would like to set up a call to determine how to reduce capital gains in your portfolio, click on the link below. If you would like us to give you a second opinion on your portfolio or financial plan, then click on this link to set up a free, 20-minute retirement rate success call. There’s no obligation. This is a 15-20 minute call where we will:

- Look at your current situation and what’s working and not.

- Get clear on where you want to go and what’s possible.

- Share with you some strategies and tips that I provide to my clients like you that can help you close the gap.