How can I invest in stocks with high dividends?

Do you require investment with a good income source? Stocks with the highest dividend is an excellent investment option. Dividend stock investors can buy shares in their companies at varying rates of return from their investments. Most dividend stock markets give investors a fixed sum every month, and pay higher payouts with each quarter so they can create a cash stream similar to annuities. Investors can also choose to use dividend reinvestment when there are not enough streams available for their investments. Tell me about the dividend process. Companies paying dividends generally have a long history and therefore, dividend stocks can add stability to your portfolio.

Note: In this article: company, stock, and equity are all the same thing.

The Best Dividend Stocks Of 2022

You may be wondering about stocks with biggest dividend or cheap stocks with good dividends. Dividend investment provides investors with stability of income over a long period of time. If dividends are reinvested you will be able to boost their return on investment. Currently, dividend payments represent about 40% of the S&P 500 earnings. A high yield Dividend Stock or one with dividend increases can help protect against inflation because it also provides a return and increases capital gains to compensate for higher costs. In 1991 through 2015, dividend stocks produced nearly twice as much profit as securities.

Tell me the difference between Dividends?

Dividends are the distributions made to shareholders by the companies’ board of directors. Dividends are typically distributed quarterly and are paid in cash or by investing into new stocks. Dividend yields are divided by the share price and expressed as dividend/price per cent of an industry average. Common shareholders can take a share in a company if their stocks remain in the hands of the company before the exclusion.

Best Thing Dividend Stocks Offer in 2022

Investors who invest in dividend growth or companies with regular dividend increases know something less experienced yield hunters don’t know. The best dividend stocks can provide superior overall returns over time, and even with seemingly hob-hob-hum dividend yields. The highest dividend stocks sp500 have offered great returns over the past 50 years. Among other things, dividend increases increase returns on investors’ original cost-based basis. Invest long enough and you’ll get an impressive 11% return. We will never forget the compounding of american stocks with high dividends.

Methodology

Our selection of dividend stocks has 9 important criteria. All stocks must demonstrate: As of now, only 25 US stocks meet all of the aforementioned criteria. This list lists 10 best dividend yields. Remember, dividends are nice and should be considered when making an investment decision. Ideally, a dividend stock has financial strength and is growing. Continued stable and growing indicates a sustainable and likely regular increase in dividends for a long time. This is not an investment advice report that should suit your investment portfolio.

Tell me the best way to buy dividend-paying investments?

Those seeking dividend investments can use diversified options such as stock, mutual funds or ETF options. A dividend discount and Gordon growth model can guide the investment decision. These tools depend on expected future income streams for valuation of shares. To compare multiple shares based on their dividend payment performance, investors may use the dividend yield factor based on the current market price the shares are traded in. Dividends are quoted as the amount the shares receive as dividends per share (DPS). You are not trying to find the lowest price stock with highest dividend. OK?

Dividends of Funds

Dividends received from funds like bonds or mutual funds differ from dividend payments received from corporations. Funds employ a NAV-based principle whose value reflects their own holding value as well as the price of the asset assets they hold. Regular dividend payment cannot imply stellar performance by the investment firm. The bond fund can pay quarterly dividends as long as the interest earned on the holdings are repaid and can transfer the interest in a certain amount only fully or partially to the fund.

Why do companies pay dividends?

Investors typically consider Dividend as reward for investing in a corporation. Dividends pay dividends and improve investor confidence in a company. A highly valued dividend declaration or a company with a history of dividend increases may show the firm does well in the business. The data also suggests that the firm lacks favorable plans to achieve more revenue. Therefore, the firm reinvests cash instead and pays shareholders. Having a long history of distributing dividends and removing them can indicate that the business is in trouble.

Understanding Dividends

Shareholders are obligated to grant dividends through voting. Although dividend money is common, dividends can be given in shares and eps growth is a consideration for a company when declaring their dividend rate. Several mutual funds also pay dividends. Dividends are paid to investors who invest in a firm’s equity and are usually generated by the net profits of the firm. Although earnings can be kept in an individual company as retained revenues to use for ongoing or future business activities, a portion of this surplus could be distributed to investors as dividends. That’s why it’s important for a company to have eps growth when it’s paying dividends.

How do dividends affect stock prices?

Dividends are impacting stock prices and the price can increase approximately by the amount of dividend declared and then decline by an equal amount at the opening of an ex-dividend. A company whose share price is $600 a share declares a $2 dividend on its first day of trading. Shares will rise as soon as they are released. If shares are traded for $65 within 365 days of revaluation. On the ex-dividend date, the stock has been adjusted by $2 and begins trading at a share price of $61 on the expiry day.

Dividend stocks vs dividend funds

Dividend stocks can be invested through investment in mutual funds or exchange-traded funds where dividend equities are held with the goal of growth and income. ETFs and index-fonds provide investors with the ability to buy or hold multiple dividend-related investments. The funds then give you regular dividends that can be taken for profit and reinvested. Dividend money offers instant diversification even when a fund’s stock may have reduced its dividend.

Past Performance of Dividend Stocks

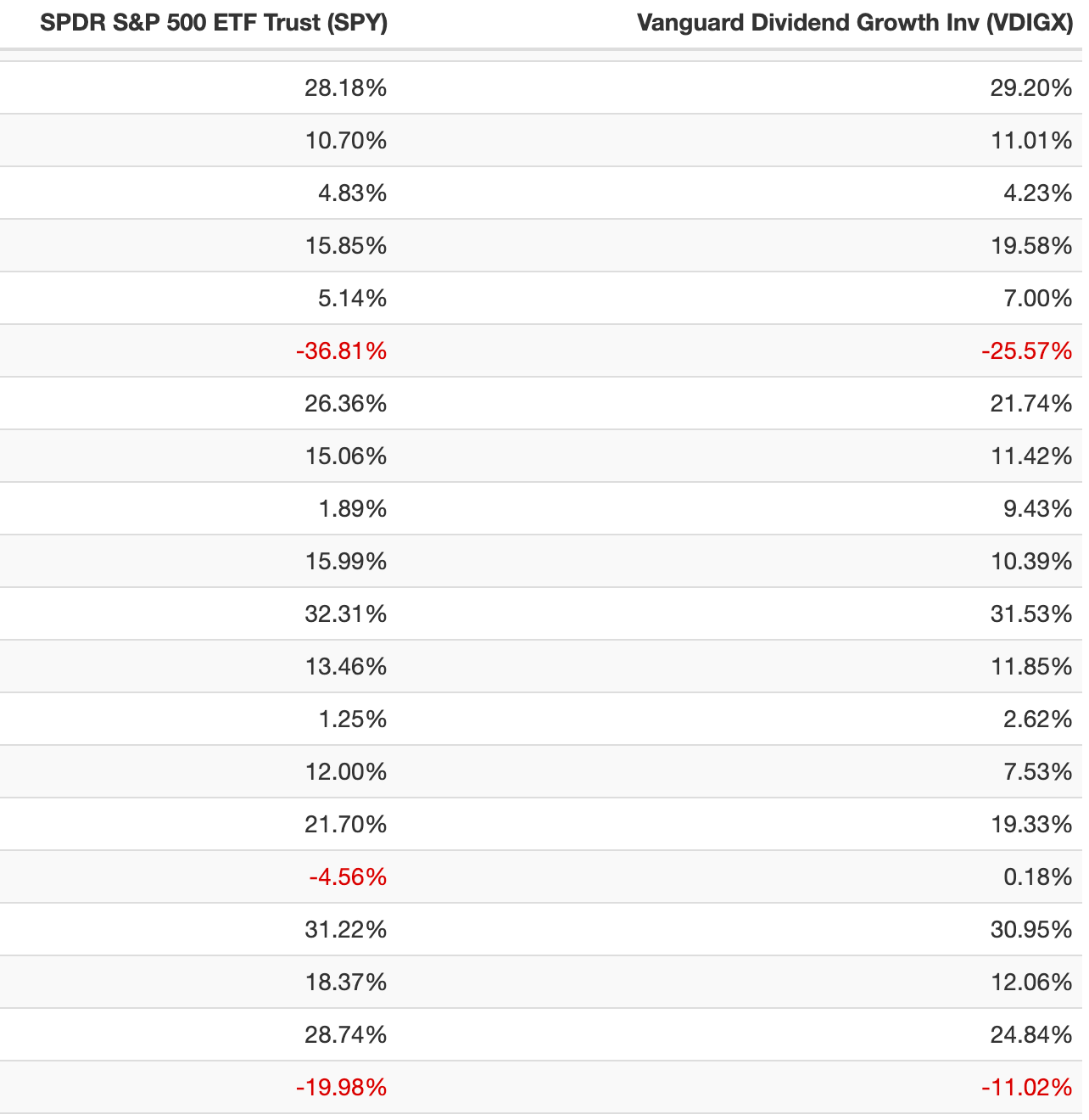

For the purposes of this paragraph we will be looking at the Dow Jones US Dividend 100 Index. This index measures the performance of high dividend yielding stocks in the US. It was launched in August of 2011 and has a 10 year annualized return of 13.44% ending 6/30/2022. During the same time, the S&P 500 has yielded 12.46% per year. But what did dividend stocks do in 2008? The Vanguard Dividend Growth Fund went down 25.57% while the S&P 500 went down 36.81%. What about this year? The S&P 500 is down 15.42% thru July 21st. While US dividend stocks are up 8.83% YTD. So as we can see high yield dividend companies hold well in market declines and go up in bull markets nicely. Very little downside too investing, historically, compared to the S&P 500. In other words, there is not an easily seen value in buying the S&p 500 over dividend stocks. You look for dividends and often times you get growth these equities. But of course in the years ahead only God know what will happen. Earnings and growth are not guaranteed or even predictable. [On the chart below the first year is 2003 and the last is 2022 to 6/30/2022.]

Dividend-paying companies

Companies with predictable profits are often the most profitable for shareholders and have the highest dividend yield. Funds can issue quarterly dividends according to their investment objectives. Startup firms, especially those in biotech or the biotechnology sector, may not offer regular dividends as they might still have an early stage in development. Again we are not necessarily trying to build a list here of the top ten dividend paying companies as those change regularly and a list today will not be useful tomorrow when the sun comes out as Annie would sing.

Are dividends irrelevant?

Merton Miller & Franco Modingliani argued in their paper that dividend policies have no effect on stock share price, market prices, or costs. An investor may not be able to accept dividend payments if a company is unable to pay out the dividend. If dividends are lean then investors could sell them instead. In the two cases, the amount invested in the business and the assets are the same.

How often are dividends distributed to shareholders?

Dividends are generally divided quarterly by shareholders although some companies pay dividends semiannually. Payment may take place in cash or as a reinvestment in shares in company stocks.

Important Dividend dates

Dividend payments are made chronologically according to events and dates, which are critical factors in determining who will qualify.

Stock with highest dividend

Ok you asked for it and really want to know. It’s far from a hot stock tip. The stock with the highest annual dividend now is SuRo Capital Corp. SuRo is a non-diversified closed-end management investment company. So it invest into other companies. So it’s not really a company itself with real earnings and growth that an investor can value. This fun pays dividends and performs based on its underlying companies. It is paying an annual dividend yield of a whopping 104%.

Earnings Per Share (EPS growth)

EPS growth is important to equities that are committed to paying higher than average dividends because it means that the a firm is earning more when EPS is increasing. If a company has eps growth then naturally they will be more easily able to pay dividends.

Yield Compared To The S&P 500

Dividend stocks can be a wonderful way to both invest in the US stock market with more of a stable performance of your portfolio while receiving a steady income. The stocks with the highest dividends are typically going to be stocks with dividend yields that are above 3%. Now that is if you’re talking about stocks on the S&P 500. The stocks on the S&P 500, the large stocks that are paying the higher dividends are going to be on average above 3%. That’s what you want to look for, the stocks that are in decent financial shape as well.

Dividend Yields On Large Cap US Equities

Annual dividends should be in the range of 3% or higher. If you’re looking for the highest annual dividend stocks of large cap companies. Now we can look at other company offers and see that you can get higher dividends from companies that are smaller cap companies. The price per share on many of these companies are going to be lower than some of the large cap stocks. And that’s going to input the dividend yield that the company is fitting out. The investing information that you need before you’re getting ready to invest in a stock that pays their dividend share quarterly will be some very important items that you need to take into consideration.

How Closely Should I Look At The Payout Ratio?

The company needs to have still reasonable EPS growth and a dividend rate that is above its peers. You also want to look at the payout ratio compared to how much the company is earning. Sometimes a payout ratio can be very low, but the company can still be paying a decent dividend. On the other hand, if you have a low payout ratio and a low dividend, then it’s a situation where it’s probably not going to fit your criteria for being a good dividend-paying stock.

Quarterly Dividends and Reinvesting

Many of the best dividend stocks will pay the quarterly dividend on a calendar year basis using January, April, July, and October, the very first of the month and that’s how they’ll do their quarterly dividend payments to their shareholders. A stock should pay a regular income. Earnings and growth can help a firm pay more dividends naturally. And you can, of course, reinvest those dividends to further increase the purchase of more shares in the future, which of course will make it where you’re going to be getting paid more dividends in the future. It is a compounding effect. When you start to talk about annual dividend and the payments that are sent out.

Don’t Just Look For the Highest Dividend

Many income investors will only look at the dividend yield in order to calculate their desired growth potential and label them as the best dividend stocks. When income investors only look at the dividend yield, they are putting themselves in a situation where they might end up buying a stock that is really not that good. Right now, you can go and look at stock with the highest dividend and it’s going to be a micro-cap holding company that’s paying over 1,000% dividend yield, which really is not what you want. Dividend stocks, at least the ones in the S&P 500 paying around 3.3% in the summer of 2022. Dividend stocks are not sometimes going to pay extremely high yields, but the dividend yield should be well above their market peers.

LTDs, LPs, And Closed End Funds Are Some Of The Top Payers

As we look at currently where some of the top dividend stocks are and consider investing in the US from small, mid and large cap stocks, you see a lot of them are real estate or LP. For example, a high-paying dividend stock right now is golden ocean group, LTD. They are paying a dividend of 18.4%. A lot of the other high dividend yield equities are going to be LPs. And that’s important to realize. The larger the company, the lower the dividends in general.

Altria Group

For example, if we want to invest in some of the higher paying dividend stock for the large cap companies, then you’re going to start talking about right now the Altria Group, Inc. Ticker symbol MO, they are currently paying a dividend of eight and a half percent here in the summer of 2022. Their price is in a position where they’re able to do that. Their stock price is roughly about $42 today in July of 2022 and so many people can afford that. Altria Group is attracting many dividend hunters, although I’m not sure about Altria’s growth in the coming years.

Lumen Technologies Inc

As income investors we are not focusing so much on growth, although we will get it, what we begin to look around for dividend stocks right now as I’m writing this blog article about stocks that have a higher dividend yield in the summer of 2022, we have Lumen. Lumen Technologies Inc is paying a tremendous dividend of around 9% and that is attracting all types of investors. But they just go in and they look at the company and they say, “Okay, we’re going to go and invest with them.” There are not a lot of securities that are large caps that are going to pay an annual dividend over 5%.

Dividend Payments

So we just have to realize that and their quarterly dividend is probably not going to be more than 1% a quarter. These dividend stocks can also provide steady capital growth and steady growth as well. Capital gains on these funds, certainly you’re going to have to deal with capital gains because they are going to be bought and sold each year based on their dividend.

Turnover

So the turnover is not huge, but it’s enough where it’s going to put the portfolio in a situation where it’s going to have to make buys and sells at the end of each year to find other top dividend stocks that are able to pay the annual dividends and the quarterly dividends that the dividend payers are looking for. As we look at this, we also have to remember it is not stock trading that is being done here. Stock trading is much higher turnover where maybe there’s a trade being placed every day or every week even.

High Cash Flow Firms

Many of these stocks have a high cash flow where they’re able to pay the income investor and also they’re able to still grow their company. The high cash flow to these corporations that are paying these steady incomes also are able to have sometimes a higher payout ratio. The population growth in the US has not been that much over the past 10 years as far as percentage grows. But there’s still many investors who want to be able to buy stocks and other dividend-paying financial products that will produce an income for them.

Investing In ETFs For Dividends

One of the things that we look at for a dividend income-paying stock is also what has been the volatility of their historical price. Their stock price we don’t want to be overly volatile, that’s going to make things difficult. One of the things I do for my clients when I’m investing in equities with dividend increases is to also go with a large basket of them, either through using a mutual fund or ETF. This type of company can offer my investors a great income and total return through low cost and diversification.

Good Ole Home Depot

As we look at some of the top dividend stocks that are large cap right now, one that comes to mind is of course Home Depot. Home Depot is probably the world’s largest maker of home goods. They are in most all major cities in the US and they continue to make sales even after the pandemic. Another good dividend payer is Pepsi. Pepsi’s current dividend is around 4.3%. And for a company that’s one of the world’s largest maker of soda, it’s not that risky have an investment.

The 2 Best US Large Cap Dividend Paying Stocks

But really Home Depot and Pepsi are the best of the large caps right now that are paying good dividends. They are excellent at repeatedly paying, being dividend payers. And they’ve also had good of their stock price. The cash flow on Pepsi and Home Depot has been excellent when their objective is to pay an annual dividend that will be good for income investors.

What About Buying Amazon for Dividends?

And one of the things that we can also look at is market share. And I think when you talk about that with a company like Home Depot, the that they have on home goods is very impressive. I don’t know exactly what it is, but my assumption is is that it is extremely high. And each quarter they have a quarterly meeting to learn how much they need to pay shareholders and based on their company’s earnings what the investors should be paid. Particular stocks will have dividend increases while some won’t. For example, the data on Exxon is impressive as they have had average dividend increases of 6.3% per year for decades. Where as, Amazon has little to no dividend increases. So those looking for more money each year in dividend income will want to avoid Amazon. Amazon is a clear growth play.

Payout Ratios Are Higher Usually

A lot of these don’t have a tremendous amount of cash on hand. But they do have a certain amount of cash per share that is going to end up averaging higher than many of the other companies that are paying lower dividends. The payout ratios on a lot of these income-producing stocks is much higher than other opportunities that don’t. When a company announced that they were going to pay a dividend in the past, it would cause income investors to take notice of what they were doing. And also as I look at how some dividend stocks have performed over the past recent years, it has been very favorable to the S&P 500.

Real Estate investment trust

REITs have outperformed gold, us and foreign stocks so far in the 21st century bolstering an average annualized return of 10.10% since January 1st, 2000. However, real estate investment trust are down around 21% YTD 7/20/2022. These investments do offer a yield of 4.3% as of today and historically their dividend yield has been higher than the dividend yield of the S&P 500 because that is what these investments were designed to do. Pay income. So if you are just focusing on dividend yield the REITs really are great dividend payers.

2 Good Places To Buy “Baskets” of Dividend-Paying Stocks

With companies like Schwab and Fidelity that offer brokerage services where you can buy a basket of these stocks inside of an account or exchange traded funds or mutual fund can pay shareholders, it makes investing in dividend stocks a much more diversified venture without having to create trading fees or put a tremendous amount of money in. Our dividend stocks over the past five years have really outperformed the S&P 500 and done quite well over the past five years. This may continue as baby-boomers (the ones with the money) look for stocks more focused on annual dividend or dividend yield.

Historical Performance of Our Firm’s Dividend Equities

The dividend stocks that we work with have averaged about 13.21%, whereas the S&P 500 has done about 9.8% per year over the last five years. So as you can see they have experienced more growth than the S&P 500. Now, that’s from July 22nd, 2017 to July 21st, 2022. Over the past three years, our dividend-paying stocks, to our clients, have paid about 14.19%. And the S&P 500 has earned and grown about 9.9%.

Our Dividend Portfolio Results Over The Last Year

Over the last calendar year, over the last year at 12 months, the dividend-paying stocks for our clients are down about 1.4% while the S&P 500 is down 9%. And of course, yield to date here in 2022, July 22nd, the dividend stocks that we have are down about 8.5% while the S&P 500 is down about 16.8%. So clearly over a time period of we’re talking five years, our dividend-paying stocks have outperformed the S&P 500 by close to two and a half percentafter our management fee.

Dividend Yield Range Per Share To Look For

This is a very good way to go I think if you want to invest in stocks, but also be able to not have your portfolio be as volatile. You will get steady growth from top dividend-paying stocks. assuming they’re not in financial trouble and they’re some of the larger ones. If you want to get into dividends that go above 5% and especially as you approach 10%, you’re going to be dealing with smaller cap stocks, you’re going to be probably moving into the natural gas or integrated oil giant companies. You’re going to be dealing with a lot of limited partnerships and other types of companies that offer these higher dividends.

What about Natural Gas Investments?

Some of these companies may even have a low payout ratio that are offering these tremendously high dividend yield. As we look at natural gas and some of the dividends that they pay. They can pay historically a very good dividend yield. However, the price of natural gas went down so much, many investors are burned because during this century the price has got so low that many of the natural gas income investments in our country went under or did not pay the investors hardly anything. So natural gas is certainly one of those situations that can change over time. The investor must decide if they need a quarterly dividend that is much higher than what they’re doing with other normal stocks.

What Is the Average Dividend For The S&P 500?

As of 7/22/2022 it is only about 1.5%. A normal large cap US stock is probably not going to pay much more than one or 2% depending on the industry it’s in and the size that it’s in. But if you’re looking at the S&P 500, their annual dividend is probably not going to be much above 2% for a normal company on there. As we stated before, the dividend yield or annual dividend on many of the better large cap companies you can expect average around 3.3% here in the summer of 2022. Dividends are something that asset managers would definitely focus on as well as wealth managers.

Set Up A Retirement Ready Success Call

If you would like to set up a call to determine how dividend stocks may be able to fit into your portfolio, click on the link below. If you would like us to give you a second opinion on your portfolio or financial plan, then click on this link to set up a free, 20-minute retirement rate success call. There’s no obligation. This is a 15-20 minute call where we will:

- Look at your current situation and what’s working and not.

- Get clear on where you want to go and what’s possible.

- Share with you some strategies and tips that I provide to my clients like you that can help you close the gap.